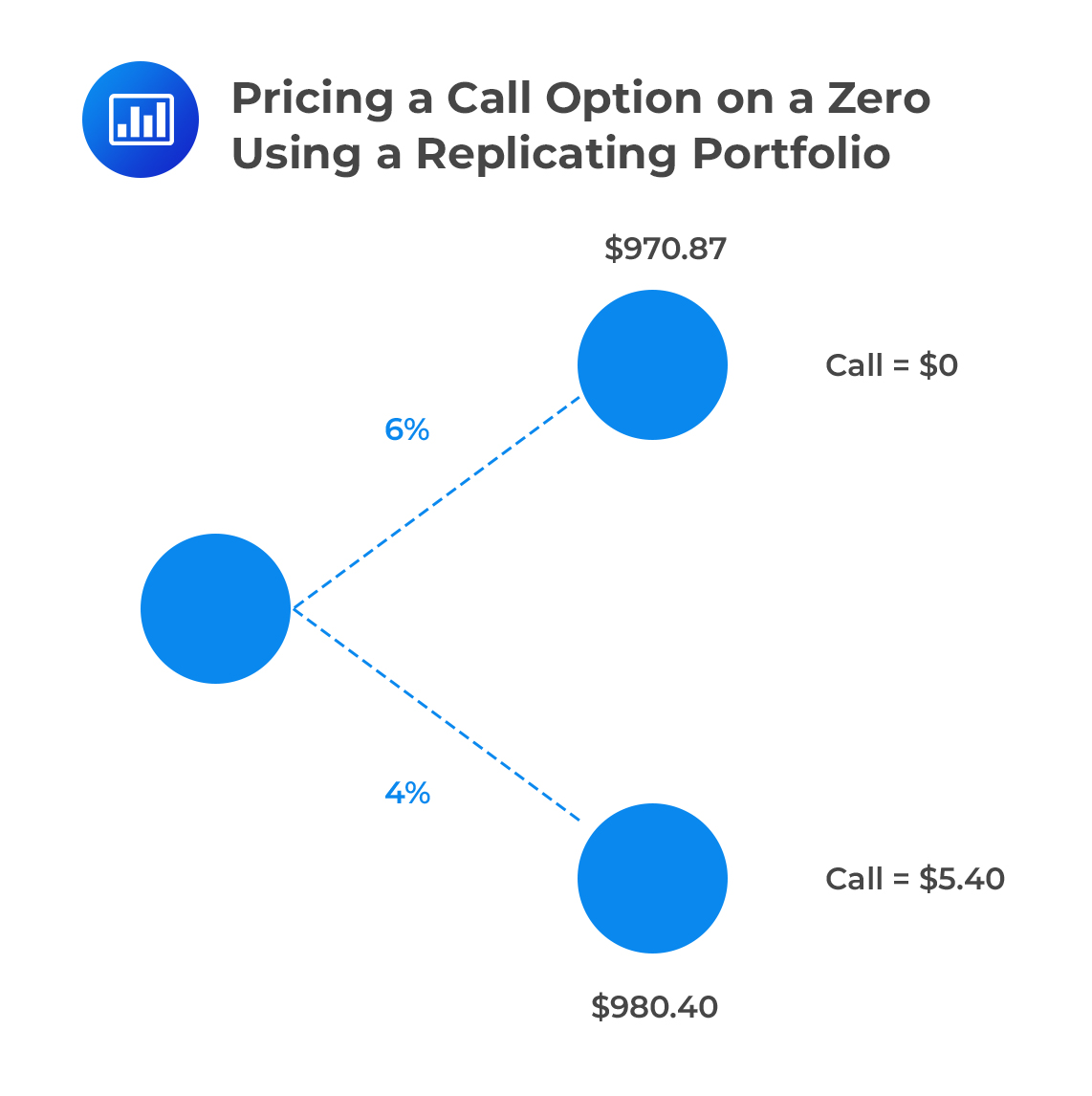

Pricing a Call Option on a Zero Using a Replicating Portfolio - CFA, FRM, and Actuarial Exams Study Notes

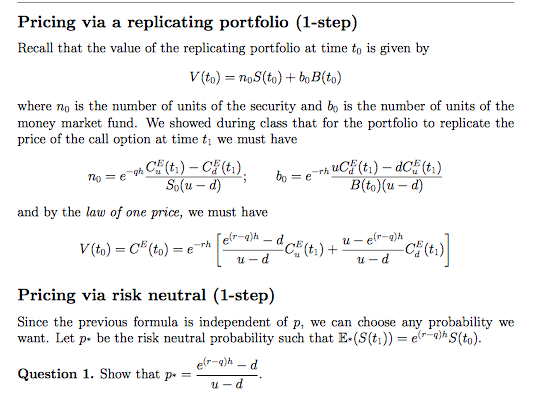

replication - Understanding the relationship between the Black-Scholes formula and a replicating portfolio - Quantitative Finance Stack Exchange

Black-Scholes Derivation — Portfolio Replication Argument | by Andrea Chello | The Quant Journey | Medium

![PDF] Real option analysis in a replicating portfolio perspective | Semantic Scholar PDF] Real option analysis in a replicating portfolio perspective | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/c85d7e4d247c95d71a585a7e828f1900ebdb7722/12-Figure2-1.png)